15.06.2023

A red flag from macro momentum

The message from Qi has been consistent for 3 months now.

US equity markets are rich to model but macro momentum is healthy. Model value has been trending higher suggesting aggregate macro conditions have been improving. So, on that basis it wasn't a fade; rather markets were simply moving faster than fundamentals.

That may be changing.

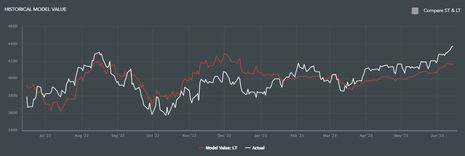

The chart below shows a divergence pattern is starting to open up on the S&P500. The rally has accelerated but macro momentum is stalling.

US equity markets are rich to model but macro momentum is healthy. Model value has been trending higher suggesting aggregate macro conditions have been improving. So, on that basis it wasn't a fade; rather markets were simply moving faster than fundamentals.

That may be changing.

The chart below shows a divergence pattern is starting to open up on the S&P500. The rally has accelerated but macro momentum is stalling.

The result is a substantial Fair Value Gap - SPX is now more than one standard deviation rich on our models. That's 4.7% and very much towards the top end of the valuation gap range.

The picture is even more acute looking at technology. Macro-warranted fair value for the NASDAQ has actually fallen 0.9% in the last week.

That leaves the NASDAQ as 7.5% rich to model.

That leaves the NASDAQ as 7.5% rich to model.

Away from Qi, positioning and sentiment indicators are generally consistent with a "melt up" scenario.

Having been short / underweight during all this AI-driven buzz, bears are being sucked in ahead of month / quarter / half year-end. FOMO is a powerful dynamic so stepping in front of it, especially around fixed reporting dates in the calendar, is tough.

But note these are strong models. Model confidence sits at 89% for SPX and NDX, and both are seeing R-Squared numbers grind higher. Macro is slowly becoming more influential.

Having been short / underweight during all this AI-driven buzz, bears are being sucked in ahead of month / quarter / half year-end. FOMO is a powerful dynamic so stepping in front of it, especially around fixed reporting dates in the calendar, is tough.

But note these are strong models. Model confidence sits at 89% for SPX and NDX, and both are seeing R-Squared numbers grind higher. Macro is slowly becoming more influential.

This is not an immediate bearish call-to-arms. It is a warning that as we think about early July and the start of a new quarter, the risk-reward is starting to look a little skewed.

- Is the AI narrative largely priced in? Macro is becoming more important

- and macro momentum is waning.

- It could just be a pause that refreshes but

- valuations are stretched.

Aligning Qi model value with Qi's Fair Value Gap is going to be a critical indicator to monitor in the weeks ahead.