03.04.2023

The Aussie battler

After the initial excitement, the China re-opening trade has generally underwhelmed. Last week's news about Alibaba splitting up into six "baby Babas" has rekindled hopes that the tech sector at least could kick back into life.

What about other China trades? The Aussie Dollar appears to have lagged the most recent bounce in risk appetite. What's the quant macro perspective on the Aussie?

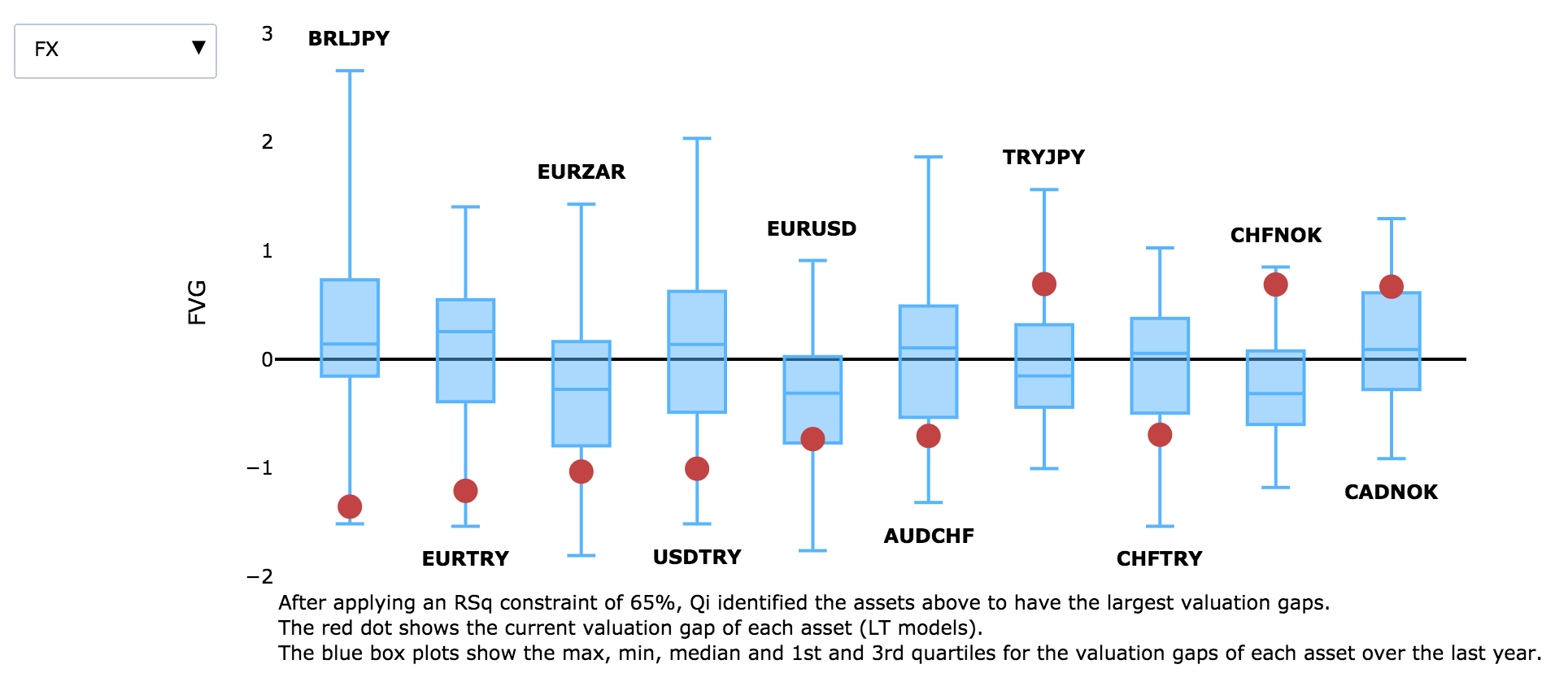

This is our Watchlist of various Aussie fx crosses:

What about other China trades? The Aussie Dollar appears to have lagged the most recent bounce in risk appetite. What's the quant macro perspective on the Aussie?

This is our Watchlist of various Aussie fx crosses:

What stands out?

- Amongst the majors that are in macro regimes, Aussie screens as modestly cheap versus the Euro, Yen and both Kiwi and Canadian Dollar.

- The issue is macro momentum points to further Aussie depreciation.

- For example, since mid-March, Qi macro model value has fallen 1.25% for AUDNZD and 2.3% for AUDJPY; over the same period, macro-warranted model value for EURAUD has risen 1.8%.

- It's the same basic dynamic each time - interest rate differentials and risk appetite (VIX + corporate spreads) have driven the model moves.

- Tomorrow's RBA announcement will be important. But it is important to note the current pattern shows that, for these FX pairs, Aussie is not the chief beneficiary during periods of "risk on".

The exception is AUDUSD

Macro fair value has bounced 2.9% since mid-month.

Why? The chart below breaks down the attribution of the recent move. Every factor moved in its favour but the key drivers were metal prices, interest rate differentials and "risk on" (tighter credit spreads, lower VIX).

Macro fair value has bounced 2.9% since mid-month.

Why? The chart below breaks down the attribution of the recent move. Every factor moved in its favour but the key drivers were metal prices, interest rate differentials and "risk on" (tighter credit spreads, lower VIX).

There's a modest valuation edge. Qi has AUDUSD as 1.0% cheap as spot has slightly lagged the improvement in macro conditions.

When the valuation gap is modest, the investment conclusion is what model value does next is critical.

If you believe April can maintain a strong risk appetite vibe... if you believe tomorrow's RBA keeps future rate hike options open... then ignore the cheaper valuations on other Aussie crosses, AUDUSD upside is the the most efficient play.

If you believe April can maintain a strong risk appetite vibe... if you believe tomorrow's RBA keeps future rate hike options open... then ignore the cheaper valuations on other Aussie crosses, AUDUSD upside is the the most efficient play.