07.06.2021

The impossibility of a 'bottom-up' equity strategy

Every portfolio is effectively a macro portfolio even when it purports to be bottom up. However you pick the stocks, you usually end up with something that is largely driven by macro factors.

By George Hatjoullis:

One of the first things that I confronted as a young finance academic (this is pre-history) was the impossibility of running a portfolio of stocks selected for their individual merits. The reason was, once the portfolio had more than a certain number of stocks, the specific risks of individual stocks become largely irrelevant. This is the whole point of diversification. Unless the portfolio holdings are skewed towards one or two stocks the portfolio would be defined by its systemic risk; the risk that cannot be diversified away. If the portfolio consists, say, of bank stocks, then its risk characteristics would accord with those factors that impact all banks. The portfolio risk would be dominated by macro factors such as GDP growth, Inflation, interest rates, credit spreads, and so on. If you check the top ten holdings of any of your funds you will notice it is rare for any individual stock to constitute more than 2-3% and the holdings usually exceed 50 stocks. Every portfolio is effectively a macro portfolio even when it purports to be bottom up. However you pick the stocks, you usually end up with something that is largely driven by macro factors. For those that doubt the veracity of the paragraph take a look at Chapter IX of Portfolio Analysis by J.C. Francis and S. H. Archer, Second Edition, Prentice-Hall, 1979. I am sure there are more up to date discussions of this point but this was the Chapter that made me think back in 1979.

If we accept the premise of the above paragraph then this has profound implications for portfolio management and the wider fund management industry. Portfolio outcomes are determined by a well defined and finite set of macro factors. Macro has always been the only game in town. Portfolio outcome variation has been driven by selecting stock portfolios which were unwittingly weighted towards specific macro factors but attributed to marketing objective of the fund. The understanding of this issue has slowly emerged and we have seen much written about factors in terms of value, momentum etc. However useful these broad categories might have proven they are not clean macro factors. Some banks are clearly value stocks but others momentum or growth stocks. The need for a well defined set of macro factors that could capture portfolio differences remained. One attempt to fill this need is a company called Quant-Insight (https://quant-insight.com), and in which I own a small shareholding.

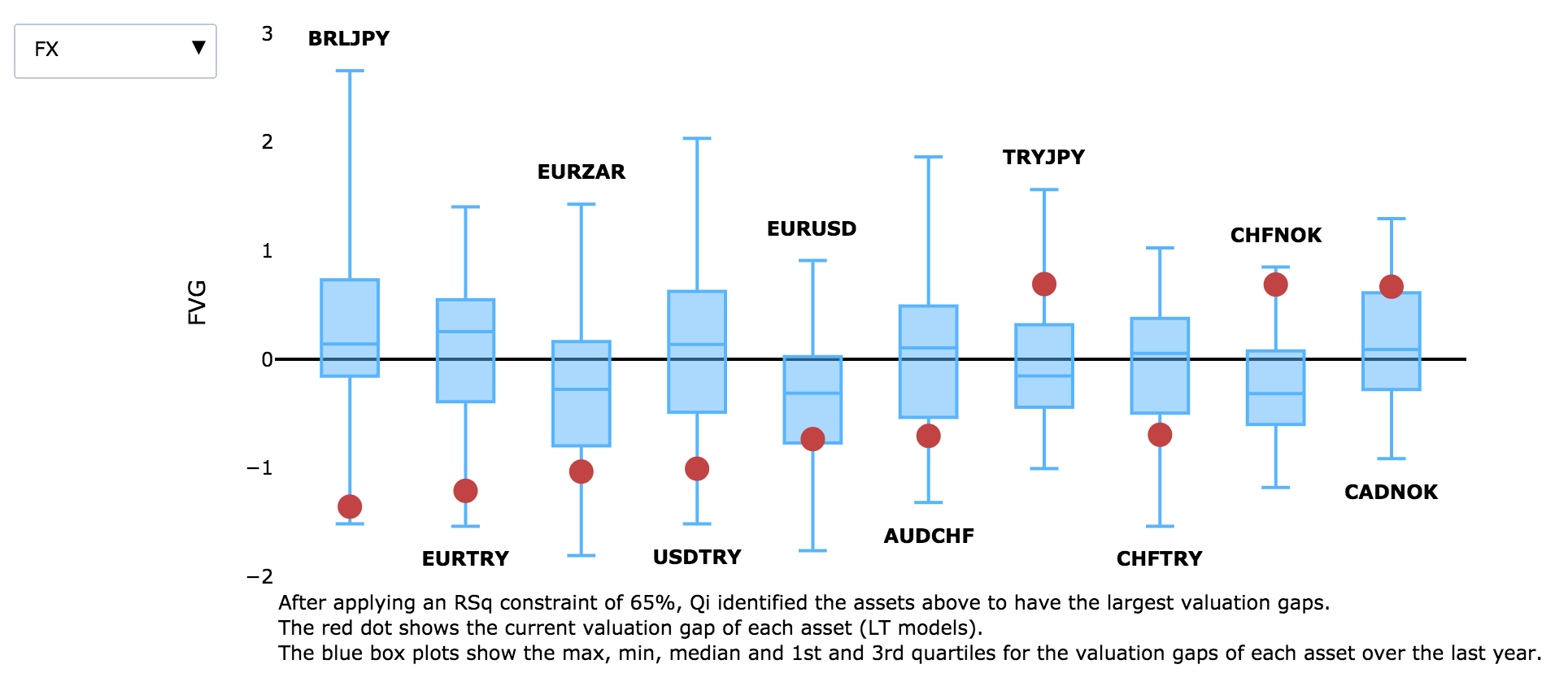

QI offers a set of independent and finite macro factors against which most diversified portfolios can be characterised. QI tells you what you have in terms of well defined factors such as growth, inflation, credit spreads, interest rates etc. QI tells you if the value of your portfolio (or individual stocks or other portfolios) is out of line with the historical relationship with the set of macro factors. QI tells you how strong is this relationship and when the portfolio relationship to macro factors may be changing. QI cannot tell you how these macro factors will evolve (nothing can) but it can show you to which factors your portfolio is presently exposed. QI can also remind you that whatever you think you have what you actually is some weighting of macro factor exposure. It may be that you can achieve a more efficient portfolio with exactly the same factor weighting. A more efficient portfolio would offer a greater return for the same level of factor risk.

Read the George Hatjoullis blog

One of the first things that I confronted as a young finance academic (this is pre-history) was the impossibility of running a portfolio of stocks selected for their individual merits. The reason was, once the portfolio had more than a certain number of stocks, the specific risks of individual stocks become largely irrelevant. This is the whole point of diversification. Unless the portfolio holdings are skewed towards one or two stocks the portfolio would be defined by its systemic risk; the risk that cannot be diversified away. If the portfolio consists, say, of bank stocks, then its risk characteristics would accord with those factors that impact all banks. The portfolio risk would be dominated by macro factors such as GDP growth, Inflation, interest rates, credit spreads, and so on. If you check the top ten holdings of any of your funds you will notice it is rare for any individual stock to constitute more than 2-3% and the holdings usually exceed 50 stocks. Every portfolio is effectively a macro portfolio even when it purports to be bottom up. However you pick the stocks, you usually end up with something that is largely driven by macro factors. For those that doubt the veracity of the paragraph take a look at Chapter IX of Portfolio Analysis by J.C. Francis and S. H. Archer, Second Edition, Prentice-Hall, 1979. I am sure there are more up to date discussions of this point but this was the Chapter that made me think back in 1979.

If we accept the premise of the above paragraph then this has profound implications for portfolio management and the wider fund management industry. Portfolio outcomes are determined by a well defined and finite set of macro factors. Macro has always been the only game in town. Portfolio outcome variation has been driven by selecting stock portfolios which were unwittingly weighted towards specific macro factors but attributed to marketing objective of the fund. The understanding of this issue has slowly emerged and we have seen much written about factors in terms of value, momentum etc. However useful these broad categories might have proven they are not clean macro factors. Some banks are clearly value stocks but others momentum or growth stocks. The need for a well defined set of macro factors that could capture portfolio differences remained. One attempt to fill this need is a company called Quant-Insight (https://quant-insight.com), and in which I own a small shareholding.

QI offers a set of independent and finite macro factors against which most diversified portfolios can be characterised. QI tells you what you have in terms of well defined factors such as growth, inflation, credit spreads, interest rates etc. QI tells you if the value of your portfolio (or individual stocks or other portfolios) is out of line with the historical relationship with the set of macro factors. QI tells you how strong is this relationship and when the portfolio relationship to macro factors may be changing. QI cannot tell you how these macro factors will evolve (nothing can) but it can show you to which factors your portfolio is presently exposed. QI can also remind you that whatever you think you have what you actually is some weighting of macro factor exposure. It may be that you can achieve a more efficient portfolio with exactly the same factor weighting. A more efficient portfolio would offer a greater return for the same level of factor risk.

Read the George Hatjoullis blog