Insights

September 2, 2025

Qi Macro Risk

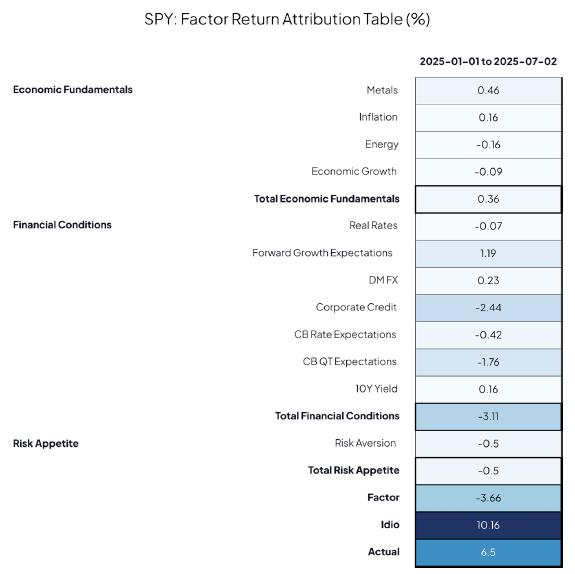

Are you a stock picker or a macro trader?

Sometimes you're both

Filters

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

Thank you! Your submission has been received!

Oops! Something went wrong while submitting the form.

.png)

.jpg)