Qi Macro Spotlight: Real Rates Remain a Key Risk for 'The Rest'

Summary:

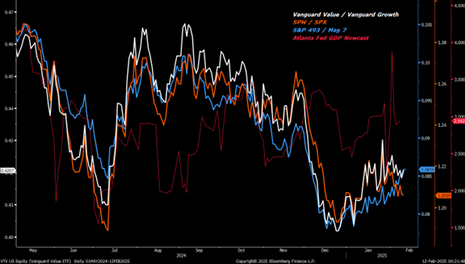

This year, a major market shift has been the rotation under the surface of the headlineindices:

- Value has outperformed Growth

- Equal-weighted S&P 500 has outperformed market-cap weighted

- The S&P 493 has outperformed the Magnificent 7

These rotations have rebounded from multi-year lows –but they are one in the same. This begs the question -can this broadening market trend be sustained? Further, what macrofactors need to align? Bottom-line, real rates remain the key risk for the broadermarket outside of the defensive megacap growth stocks

Details

1. Qi’s Risk Model - Today, Value vs. Growth Have Divergent Needs:

The revelation from Qi's Risk Model is that Value and Growth have distinct and divergent needs. In turn, this has ramifications for the hope of higher market breadth i.e. SPW vs.SPX and 493 vs. Mag 7:Value wants a Goldilocks environment: A weaker dollar, lower real rates, and higher nominal GDP growth.

Growth has no issue with tighter FCIs: It wants a stronger dollar, higher real rates, and lower nominal GDP growth. As we confirm below, the hypothesis is that this is driven bya thematic bet on the secular AI narrative, which counterbalances the traditional macrorisks like tighter FCIs / lower growth.

This is a break from past norms: Over the last decade, higher real rates implied highereconomic confidence allowing respite for Value; while tighter FCIs hurt Growth byraising the cost of capital. Today, those reaction functions are different.Further, the size of these differences are stark relative to recent history: The negativesensitivity of Value / Growth to real rates is at 5yr lows; the positive sensitivity toeconomic growth is close to 5yr highs:

2. Digging deeper - MegaCap Tech is the source of Growth’s positive real ratessensitivity

Both the average market cap and forward earnings growth for growth stocks with apositive real rates sensitivity is ~80% higher compared to those with a negativesensitivity. As you can see below, MegaCap Tech’s defensive qualities is notrepresentative of the entire Growth universe.

3. Why this matters?

Real rates remain a key risk: The bottom line is that the broader market, outside of themega cap Growth stocks, still remains highly sensitive to real rates and a Goldilocksoutcome.To empirically make this point, below we show the same chart of the 3 rotations but vs.10yr real yields (inverted) and vs. the Atlanta Fed GDP Nowcast.